2024 NIBA Convention: Pitch Opportunity!

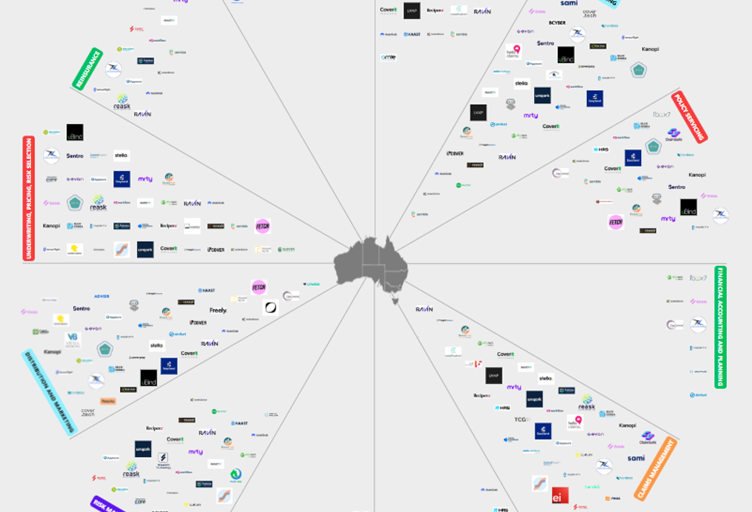

Insurtech Australia is partnering with National Insurance Brokers Association (NIBA) to identify the most exciting Insurtech disrupters for the broking sector: those poised to provide in-market solutions to enhance the way brokers...