The Inspire Insurtech Interview series is designed to inspire your fellow insurtechs. We’d like to share who you are, what you do, what we can expect from you in the future.

This month, we talked to Brett Wright, Founder of LifeBid. Enjoy!

Tell us the company’s brief pitch.

If you think about how Xero revolutionised the accounting industry, LifeBid is doing the same for Life Insurance.

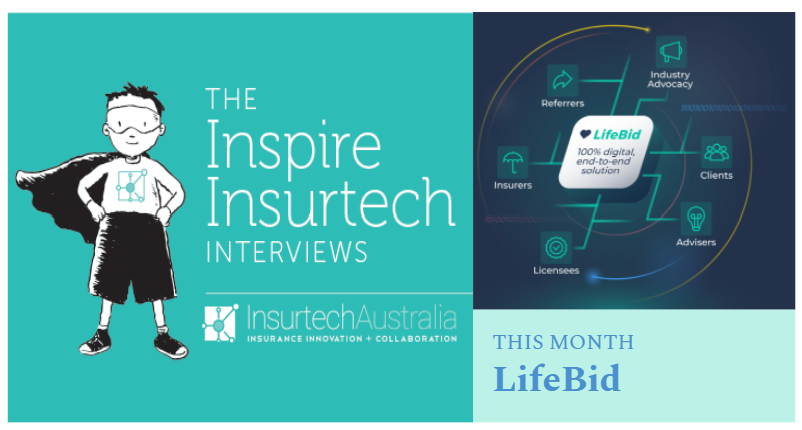

We are replacing archaic systems, processes and paper shuffling, with a 100% digital, end-to-end platform that cuts advice and distribution costs by up to 90%, enabling advice providers and insurers to 10x their capacity, whilst increasing the affordability and access to quality solutions for everyday Australian’s.

LifeBid is life insurance done faster, fairer, better… for everyone.

So how did the company begin?

Our founders are experienced life insurance advisers, plus they have over 7 years of successful technology development experience. Like the rest of the sector, we are immensely frustrated by how complex and expensive it has become for consumers to access good quality advice and cover, and how hard, unprofitable and risky it has become for advisers, licensees and life insurers to help everyday Australian’s.

The market doesn’t need a solution to do a little bit of the process quicker here, or a bit easier there – it needs LifeBid, an industry standard end-to-end solution, which is why we are here.

How has the company evolved since its inception?

We have attracted support from and partnered with industry leading stakeholders, with 6 of 9 life insurers supporting LifeBid, a critical mass of advice providers supporting LifeBid and we are working with government and regulators also.

How does your Insurtech improve your customer’s experience?

Because life insurance is a complex product, intertwined with superannuation and a mountain of regulation and compliance, ~70% of new cover is originated with the help of specialist life insurance advisers and holistic financial advisers.

Currently, the life insurance advice process is a bit like asking a consumer to drive down to Blockbuster Video to hire a VHS, when all they really want is Netflix – For advisers and the wider sector, it has become too hard to help the average Australian, stay compliant and break even (let alone make a profit) all at the same time.

With LifeBid:

Consumers – Get fast, affordable access to great advice, including renewals, reviews and claims, with a phenomenal client experience on any device.

Advice Providers and Life Insurers – Can cut the time it takes to help a new client by up to 90%, exponentially increase their retention and wow clients with refreshingly simple renewal, review and claim experiences in clicks, not hours.

What is the company’s biggest challenge in today’s markets?

Australia’s life insurance sector is world class in terms of products and claims, if we can make advice, distribution and ongoing service in the Australian market up to 90% more efficient, we can make LifeBid a success in many other international markets including NZ, UK, US and Europe (which we are also aiming to do).

The biggest challenge, but also the biggest opportunity for us as a (life) insurtech, is that so much of the investment and narrative in the insurtech space focuses on general insurance, which I think is because, life insurance is not something a lot of people understand or don’t want to think about and it has a few extra complex hurdles to tackle like the need for personal advice, harder underwriting, superannuation etc.

Our challenge is to educate the insurtech ecosystem about the opportunities in the life insurance space, which we are up for, because what we do in the life insurance space saves lives, protects family’s and changes communities for the better, every single day.

What is next for your company? What are your big goals for 2022?

Regulatory and market testing, before launching, which is exciting.

Any advice for other Insurtechs or insurers looking to innovate?

Find businesses and consumers who need the problem solved that you are solving and partner with them – in the insurance industry (both life and general), partnerships are so important, because you can’t be all things to everyone across target marketing, advice, distribution, product, underwriting, claims etc.

Thank You.