-

Insurtech Market Report

Read more: Insurtech Market ReportThis report, commissioned by Insurtech Australia, outlines a vibrant and maturing sector that is reshaping Australia’s insurance industry and holding its own on a global level. The report is a first of…

-

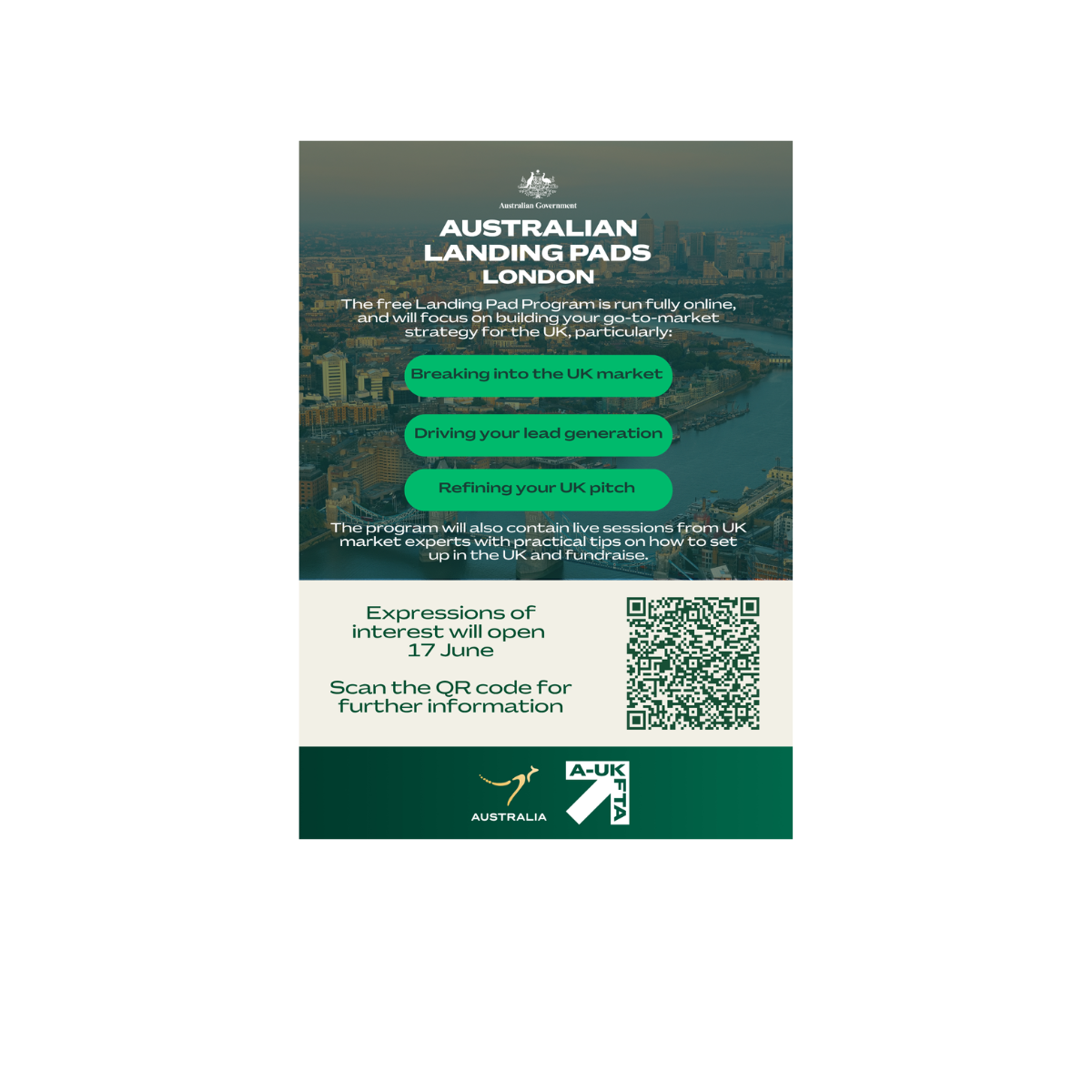

Austrade Launches London Landing Pad

Read more: Austrade Launches London Landing PadThe Australian Trade and Investment Commission (Austrade) has this week launched its London Landing Pad, a selective 6-week virtual business program coaching Australian tech businesses in successfully exporting to the UK. This…

-

ITC Asia Delegation 2025

Read more: ITC Asia Delegation 2025A keen contingent of Australasian Insurtechs have just returned from Insurtech Australia’s official delegation to Singapore to attend ITC Asia. Delegate members included Appsure, Grappler, IVAA, LifeBid, Simfuni and TCG Process. You…

-

Insurtech Australia Responds to ASIC Consultation Paper 383

Read more: Insurtech Australia Responds to ASIC Consultation Paper 383Insurtech Australia, in consultation with our members and partners, has drafted a submission to the Australian Securities and Investments Commission (ASIC) on its Consultation Paper 383: ‘Reportable situations and internal dispute resolution…

-

Insurtech Australia Submission to R&D Consultation

Read more: Insurtech Australia Submission to R&D ConsultationInsurtech Australia, in consultation with its members and partners, has drafted a submission to the Federal Department of Industry, Science and Resources’ Discussion Paper, ‘Strategic Examination of Research and Development‘. You can…

-

InsurtechLIVE 25 Photo Gallery

Read more: InsurtechLIVE 25 Photo GalleryWere you at InsurtechLIVE 25 on Tuesday 18th February 2025? Take a look at the photo gallery from the day here!

-

UK-Australia Insurtech Pathway

Read more: UK-Australia Insurtech PathwayApplications for the UK-Australia Insurtech Pathway are now open. This initiative will work towards strengthening collaboration between two leading insurance markets. The partnership between the UK’s Department for Business and Trade (DBT),…

-

InsurtechLIVE 25 Showreel

Read more: InsurtechLIVE 25 ShowreelInsurtech Australia‘s annual InsurtechLIVE was another sellout event! Thanks to everyone involved including organisers, sponsors and exhibitors, on-stage talent and those in the audience. It was fantastic to have your support. You…

-

InsurtechLIVE25

Read more: InsurtechLIVE25Our iconic Insurtech Australia annual conference took place in Sydney on Tuesday 18th February 2025. 2025 was another sold-out event! For a rundown of the day’s highlights, please follow this link. If…

-

2024 Member Survey Highlights

Read more: 2024 Member Survey HighlightsKey insights from the Insurtech Australia 2025 Member Survey have just been released. Reflective of the current market conditions, funding and cashflow management, along with securing customers and partnerships, rank among the…